Accurate and timely record-keeping allows a business owner to keep track of how their business is performing. It also provides their CPA with the information needed to prepare their tax return and advise them of the best tax strategies available for their business. Choosing the correct QuickBooks Online product allows a business owner to do this in the most efficient and cost-effective manner.

I’ve often seen clients overpaying for a QuickBooks product that is overly complicated for their needs. Some of the more complicated QuickBooks products have features that the average small business owner and independent contractor will never use. This causes unnecessary expense and frustration to the business owner.

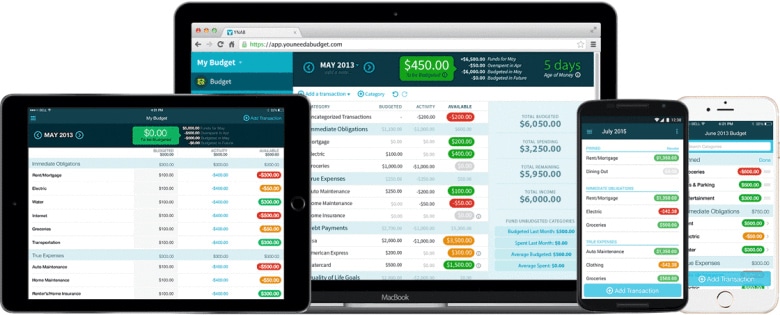

This article is focused on the most inexpensive and easy-to-use QuickBooks Online product: QuickBooks Self-Employed. This product handles the needs of many independent contractors and small businesses. If you outgrow QuickBooks Self-Employed, you can then easily upgrade to one of the three additional QuickBooks Online products built to handle the needs of a more complicated business.

Some key features that QuickBooks Self-Employed offers are:

- Cloud based – Access your QuickBooks data from any device including your phone. No need for upgrading software or worrying about losing your data if your computer crashes.

- Phone app – This app allows for mileage tracking, receipt imaging, classifying bank transactions, creating invoices, and accepting payment from anywhere.

- Mileage tracking – If allowed, the app can track all your trips. You can then indicate whether the trip was business or personal along with a description, satisfying the IRS’s log book requirement for taking the often-beneficial mileage deduction.

- Receipt imaging – You can take a picture of your receipt and match it with the corresponding expense, eliminating the need to keep a shoebox full of receipts.

- Create invoices and accept payment – Create invoices and allow clients to pay you directly.

- Bank synchronization – No more manual data entry! Download all your bank and credit card transactions into QuickBooks. You can then indicate whether the expense was business or personal and categorize the business expenses.

- Reports – Track how your business is doing with the Profit and Loss report and provide tax reports to your accountant at tax time.

- Accountant user – Set up accountant access with your CPA so that they can assist you when you need help and can pull required reports at tax time.

- Low cost – If you purchase QuickBooks self-employed through a ProAdvisor, such as myself, you receive a 50% discount bringing your cost to $5/month.

QuickBooks Self-Employed makes sense for many independent contractors and small businesses because it offers all the features you need, and none of the features you don’t, at an affordable price – If you are already in a different version I can help you convert your data to the most beneficial version for your needs saving you time, frustration, and money. Contact me today to discuss whether QuickBooks Self-Employed is right for you and your business!